I’ve heard a kind of depressing story the last couple of days about a bureau of the Postal Service tasked with opening letters to Santa Claus. Here’s a somewhat strange version from NPR’s All Things Considered in which Robert Siegel tries to lighten things up with some lame quips. They’ve been finding that, this year, kids are tending less to ask for gaming consoles and the like than stuff like warm coats, shoes, etc. Just a hint of how rough people have it these days – a peek into the Dickensian hellscape inhabited by the millions upon millions of children (and their parents) living in poverty. Our top-down economy is literally killing hope before it even has the chance to learn how to express itself.

I’m not a practicing Christian, nor am I big on organized religion in general, but if there’s one thing valuable about the Christmas season it’s the sense of possibility it can engender in people – not so much the expectation of personal gain, but more the notion that things can be better, that in the midst of an unforgiving universe, we can be fair and decent to one another. So in a way these letters show that, even in the midst of an unrelenting consumer culture, these kids are more focused on those ideals than might be expected. So even though Santa may not be coming for many of them, they are very good little girls and boys indeed.

I’m not a practicing Christian, nor am I big on organized religion in general, but if there’s one thing valuable about the Christmas season it’s the sense of possibility it can engender in people – not so much the expectation of personal gain, but more the notion that things can be better, that in the midst of an unforgiving universe, we can be fair and decent to one another. So in a way these letters show that, even in the midst of an unrelenting consumer culture, these kids are more focused on those ideals than might be expected. So even though Santa may not be coming for many of them, they are very good little girls and boys indeed.

That’s not to say that Santa isn’t coming for anyone. Not a bit of it. Our nation’s millionaires and billionaires can now expect a little something extra in their Christmas stocking, like another yacht or a Lamborghini, perhaps. Yes, the tax compromise package has been passed by both houses of Congress and is on the way to Obama for his signature. That means low, low taxes for everybody, ludicrously low estate tax rates, and an untold bonanza for the richest 1% in general. Also… a pile of additional, non-investment debt to be paid off at some point uncertain, a significant undermining of the funding vehicle for Social Security, and a paltry 13-month extension to unemployment benefits.

And for those kids, maybe some second-hand shoes for mom. Jesus… this is why we suck.

luv u,

jp

shepherd this deal through the House. It seems likely that most Republicans will support it, so he hardly needs the entire Democratic caucus. In any case, the capitulation happened a long time ago. At this point, the main thing is making certain that unemployed workers get the help they need. I don’t care how we get there, particularly, so long as they don’t give away the store… and reserve the right to start fighting again fresh on January 1.

shepherd this deal through the House. It seems likely that most Republicans will support it, so he hardly needs the entire Democratic caucus. In any case, the capitulation happened a long time ago. At this point, the main thing is making certain that unemployed workers get the help they need. I don’t care how we get there, particularly, so long as they don’t give away the store… and reserve the right to start fighting again fresh on January 1. Job one. The president has been speaking a bit more forcefully about the economy in recent days. That is good, but not good enough. We need a deeper, broader commitment to the notion of full employment in this country, and to back it up with some appropriate action. Various T.V. pundits blandly claim that there is little government can do, but I disagree. The fact is, government has to take steps to provide incentive to industry to employ workers in this country. They could start with procurement. The entire Federal Government, including the Defense Department, should require all contracts to be fulfilled with U.S. labor. If we need it, let’s build it here. We’ve got the skills, the money, and a workforce more than ready to do the work.

Job one. The president has been speaking a bit more forcefully about the economy in recent days. That is good, but not good enough. We need a deeper, broader commitment to the notion of full employment in this country, and to back it up with some appropriate action. Various T.V. pundits blandly claim that there is little government can do, but I disagree. The fact is, government has to take steps to provide incentive to industry to employ workers in this country. They could start with procurement. The entire Federal Government, including the Defense Department, should require all contracts to be fulfilled with U.S. labor. If we need it, let’s build it here. We’ve got the skills, the money, and a workforce more than ready to do the work. point in the ad he says, “Taxes never made anyone healthy.” Interesting statement. I guess he’s never heard of Medicare, Medicaid, Social Security, various Health and Human Services programs, and any number of other government services, from OSHA to the FDA, that in some respect help us stay healthier as a result of tax revenues. Yeah, I know the ad is about a “sin” tax, but you can also see how taxes on cigarettes and alcohol have had a positive effect health-wise. In a sense, it’s just a way of having the price of something reflect the true cost. Sure, we want people to be healthier. But we also want to recover some of the cost of their NOT being healthy, like emergency care costs for people who sugar themselves into heart disease, stroke, diabetes, and the like. Don’t we?

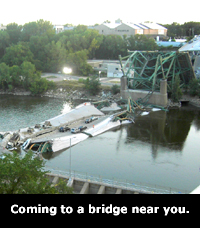

point in the ad he says, “Taxes never made anyone healthy.” Interesting statement. I guess he’s never heard of Medicare, Medicaid, Social Security, various Health and Human Services programs, and any number of other government services, from OSHA to the FDA, that in some respect help us stay healthier as a result of tax revenues. Yeah, I know the ad is about a “sin” tax, but you can also see how taxes on cigarettes and alcohol have had a positive effect health-wise. In a sense, it’s just a way of having the price of something reflect the true cost. Sure, we want people to be healthier. But we also want to recover some of the cost of their NOT being healthy, like emergency care costs for people who sugar themselves into heart disease, stroke, diabetes, and the like. Don’t we? And yet the philosophy continues to command respect. Somehow people like Grover Norquist and his ilk are still listened to, still asked for guidance. Meanwhile, the nation’s infrastructure is falling apart, our last major investments (beyond maintenance) in roads, bridges, tunnels, rail lines, etc., now decades old. A stiff wind storm knocks out power to whole states. Instead of investing in the future of this country, we’re putting band-aids over compound fractures. The most striking irony is that these programs are being starved by the kind of deficit hawks who constantly claim that they are doing this for our children and our grandchildren, i.e. not leaving them a huge debt. Fine. There’s a solution. Get people to understand that we need to pay for things, and that civilization is not free. That’s the central point of health reform, lackluster as it may be.

And yet the philosophy continues to command respect. Somehow people like Grover Norquist and his ilk are still listened to, still asked for guidance. Meanwhile, the nation’s infrastructure is falling apart, our last major investments (beyond maintenance) in roads, bridges, tunnels, rail lines, etc., now decades old. A stiff wind storm knocks out power to whole states. Instead of investing in the future of this country, we’re putting band-aids over compound fractures. The most striking irony is that these programs are being starved by the kind of deficit hawks who constantly claim that they are doing this for our children and our grandchildren, i.e. not leaving them a huge debt. Fine. There’s a solution. Get people to understand that we need to pay for things, and that civilization is not free. That’s the central point of health reform, lackluster as it may be. raising taxes, cutting popular programs, etc. That is, however, the main reason why they have been sent to Washington D.C. – to decide where the money for the federal government comes from and where it goes. If they are unable to grapple with these issues, they might consider applying for jobs at the corporations that paid for their campaigns. What irks me about the deficit reduction commission, aside from the participation of paleocons like Alan Simpson, is that they are not directly accountable to the electorate. Even more than that, commissions are usually mustered to do particularly dirty work, like cutting or privatizing Social Security to save a few bucks.

raising taxes, cutting popular programs, etc. That is, however, the main reason why they have been sent to Washington D.C. – to decide where the money for the federal government comes from and where it goes. If they are unable to grapple with these issues, they might consider applying for jobs at the corporations that paid for their campaigns. What irks me about the deficit reduction commission, aside from the participation of paleocons like Alan Simpson, is that they are not directly accountable to the electorate. Even more than that, commissions are usually mustered to do particularly dirty work, like cutting or privatizing Social Security to save a few bucks. Death and Texas. Jesus christmas. No one likes paying taxes, or going to the dentist, or taking exams, or eating their Maypo (well…. almost nobody), but this software executive in Texas who flew his plane into an IRS building should have taken an anger management seminar or something stronger.

Death and Texas. Jesus christmas. No one likes paying taxes, or going to the dentist, or taking exams, or eating their Maypo (well…. almost nobody), but this software executive in Texas who flew his plane into an IRS building should have taken an anger management seminar or something stronger.